The Critical Role of Environmental Considerations in ESG (4-Part Series)

The Critical Role of Environmental Considerations in ESG

Part 2 of a 4-Part Series

By Staci Hegarty, M.Ed.

The concept of Environmental, Social, and Governance (ESG) criteria has become a cornerstone in evaluating a company’s ethical impact and sustainability. While each component of ESG is essential, the environmental (E) aspect demands urgent attention in our current global context. Here’s why environmental considerations are paramount and how they shape the future of businesses and the planet.

What Does the ‘E’ in ESG Entail?

Environmental criteria involve assessing how a company’s operations impact the natural world. This includes a range of factors such as energy use, waste management, pollution, natural resource conservation, and the treatment of animals. It also covers the extent to which a company mitigates environmental risks and implements sustainable practices.

Key Areas of Environmental Focus

- Climate Change and Carbon Footprint: Companies are increasingly measured by their efforts to reduce greenhouse gas emissions. A smaller carbon footprint not only signifies environmental responsibility but also positions companies as leaders in the fight against climate change. This is crucial for long-term sustainability and aligning with global targets like the Paris Agreement.

- Resource Management: Efficient use of natural resources like water, minerals, and timber is vital. Companies need to adopt practices that minimize resource depletion and promote regeneration. Sustainable resource management reduces operational costs and ensures the longevity of essential resources.

- Waste and Pollution: Effective waste management and pollution control are critical. Companies must strive to minimize their waste output and manage it responsibly. This includes reducing plastic use, managing chemical waste, and ensuring safe disposal practices. Pollution control helps preserve ecosystems and protect public health.

- Biodiversity and Land Use: Protecting biodiversity involves ensuring that business practices do not harm wildlife or natural habitats. Sustainable land use practices prevent deforestation, soil degradation, and loss of biodiversity. Companies that prioritize biodiversity are seen as stewards of the environment.

Why the Environmental Component Matters

- Risk Mitigation: Ignoring environmental considerations can lead to significant risks, including regulatory fines, cleanup costs, and damage to a company’s reputation. Proactively addressing environmental risks can mitigate these potential issues. Risk mitigation may also have a role in determining future products. If a component of a product becomes scarce, it will be necessary to innovate solutions to revise or replace the need for that component.

- Investor Attraction: Investors are increasingly prioritizing sustainability. Companies with strong environmental practices attract more investment as they are perceived as lower risk and more future ready. Sustainable businesses are better positioned to adapt to changing regulations and market demands.

- Consumer Preference: Modern consumers are more environmentally conscious. They prefer to support companies that demonstrate a commitment to sustainability. This shift in consumer behavior drives companies to adopt greener practices to maintain and grow their market share.

- Long-term Sustainability: Environmental sustainability ensures that a company can continue its operations without depleting the resources it relies on. This long-term perspective is essential for a company’s survival and growth in an increasingly resource-constrained world.

- Regulatory Compliance: Governments and international bodies are imposing stricter environmental regulations. Companies that adhere to these regulations avoid legal penalties and enhance their credibility. Staying ahead of regulatory requirements ensures smooth operations and can provide a competitive edge.

Conclusion

Incorporating environmental criteria into business practices is not just an ethical imperative but also a strategic one. Companies that prioritize environmental sustainability position themselves as leaders in their industry, attract conscientious investors, and appeal to a growing base of eco-aware consumers.

The ‘E’ in ESG is critical for building a resilient, future-ready business that contributes positively to the planet. By integrating robust environmental practices, companies can drive sustainable growth and make a meaningful impact on global environmental challenges.

It’s time we give environmental sustainability the attention it deserves in our business strategies and operations. The future of our planet depends on it.

Visit our website at https://envisionrise.com.

Unlocking Organizational Potential: The Benefits of DiSC for Innovation, Leadership, and Fluency

Unlocking Organizational Potential: The Benefits of DiSC for Innovation, Leadership, and Fluency

By Staci Hegarty, M.Ed.

In the world of responsible investing and corporate accountability, Environmental, Social, and Governance (ESG) criteria have become vital metrics. While each component—environmental, social, and governance—holds significant value individually, their collective strength is what truly transforms businesses and communities. Here’s why the E, S, and G belong together in ESG.

As we navigate a flexible workforce and a constantly evolving environment, it’s vital to continually refine our work methods to stay agile. Let’s return to the basics of efficient and effective communication. We need to remember the foundations of teamwork, appreciate our differences, and learn to operate like a well-oiled machine. Companies striving for excellence in their innovation teams, leadership alignment, and organizational fluency often turn to tools and methodologies that foster better communication and understanding. One such tool that has proven invaluable is the DiSC assessment.

What is DiSC?

DiSC is a behavioral assessment tool that provides insights into an individual’s personality traits and behaviors. It focuses on four primary dimensions: Dominance (D), Influence (I), Steadiness (S), and Conscientiousness (C). By understanding these dimensions, organizations can tailor their approaches to better align with the strengths and preferences of their teams.

Benefits of DiSC for Innovation Teams

- Enhanced Collaboration: Innovation thrives on collaboration. DiSC helps team members understand each other’s communication styles, leading to more effective and harmonious interactions. When team members know how to approach and engage with one another, they can leverage their collective strengths to drive creative solutions.

- Improved Problem-Solving: Diverse perspectives are essential for innovation. DiSC encourages teams to appreciate different viewpoints, fostering an environment where diverse ideas can be explored. This leads to more robust problem-solving as teams combine their unique insights.

- Increased Self-Awareness: DiSC assessments help individuals gain a deeper understanding of their own behaviors and tendencies. This self-awareness enables team members to recognize their strengths and areas for improvement, allowing them to contribute more effectively to innovation projects.

Benefits of DiSC for Leadership Alignment

- Better Communication: Effective leadership hinges on clear and empathetic communication. DiSC provides leaders with a framework to understand their communication preferences and those of their team members. This understanding helps bridge communication gaps and fosters a more cohesive leadership team.

- Tailored Leadership Development: DiSC assessments identify individual leadership styles and areas for growth. Organizations can use this information to create personalized development plans that align with each leader’s strengths and opportunities, resulting in a more competent and aligned leadership team.

- Enhanced Conflict Resolution: Conflict is inevitable in any organization, but how it’s managed can make all the difference. DiSC equips leaders with the tools to approach conflicts constructively, understanding the underlying behavioral dynamics and finding resolutions that maintain team harmony.

Benefits of DiSC for Organizational Fluency

- Streamlined Processes: Organizational fluency refers to the ease with which an organization operates. DiSC helps streamline processes by promoting better understanding and communication across all levels. When teams understand each other’s working styles, processes become more efficient and effective.

- Strengthened Company Culture: A positive company culture is built on mutual respect and understanding. DiSC fosters these qualities by encouraging employees to appreciate the diversity of behaviors within the organization. This strengthens the overall culture, making it more inclusive and cohesive.

- Enhanced Employee Engagement: Employees who feel understood and valued are more likely to be engaged and motivated. DiSC assessments help create an environment where employees’ contributions are recognized, leading to higher job satisfaction and retention rates.

- Reduced Waste with Efficient Communications: Effective communication is key to reducing misunderstandings and inefficiencies. DiSC assessments help teams communicate more effectively, ensuring that messages are clear and understood. This efficiency reduces wasted time and resources, allowing teams to focus on innovation and productivity.

Conclusion

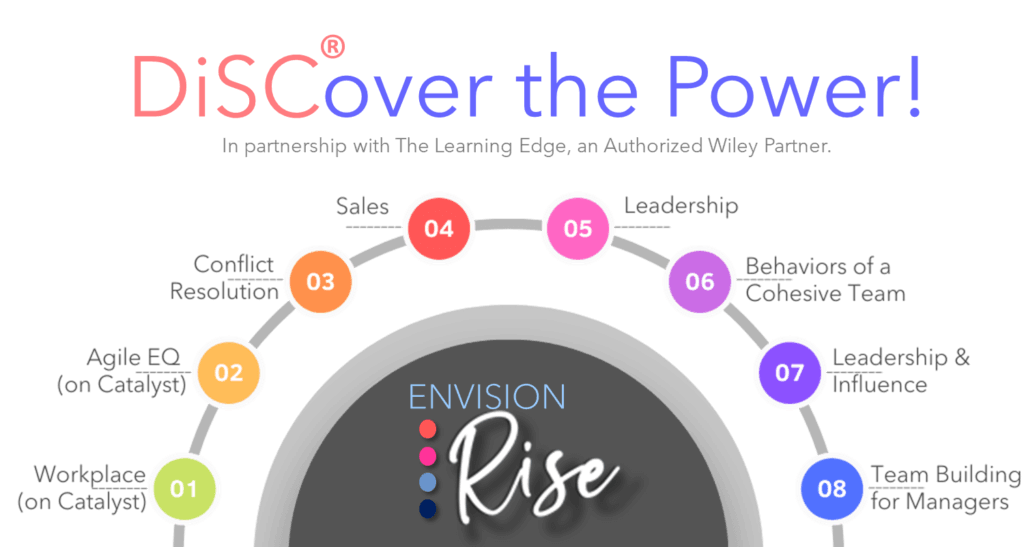

Envision RISE training offers an 8-course DiSC assessment designed to be the catalyst for unlocking the most efficient and effective ways of working within your teams. By utilizing this comprehensive program, your organization can foster better communication, enhance collaboration, and improve overall team dynamics. The DiSC assessment helps team members understand their own behavior styles as well as those of their colleagues, leading to more harmonious and productive interactions. This understanding is crucial for creating a well-oiled machine where everyone’s strengths are leveraged, and differences are appreciated. With Envision RISE, you can set your teams on a path to greater efficiency and success.

Visit our website at https://envisionrise.com.

Why Environmental, Social, and Governance (ESG) Criteria Belong Together (4-Part Series)

Why Environmental, Social, and Governance (ESG) Criteria Belong Together

Part 1 of a 4-Part Series

By Staci Hegarty, M.Ed.

In the world of responsible investing and corporate accountability, Environmental, Social, and Governance (ESG) criteria have become vital metrics. While each component—environmental, social, and governance—holds significant value individually, their collective strength is what truly transforms businesses and communities. Here’s why the E, S, and G belong together in ESG.

The Interconnected Nature of ESG

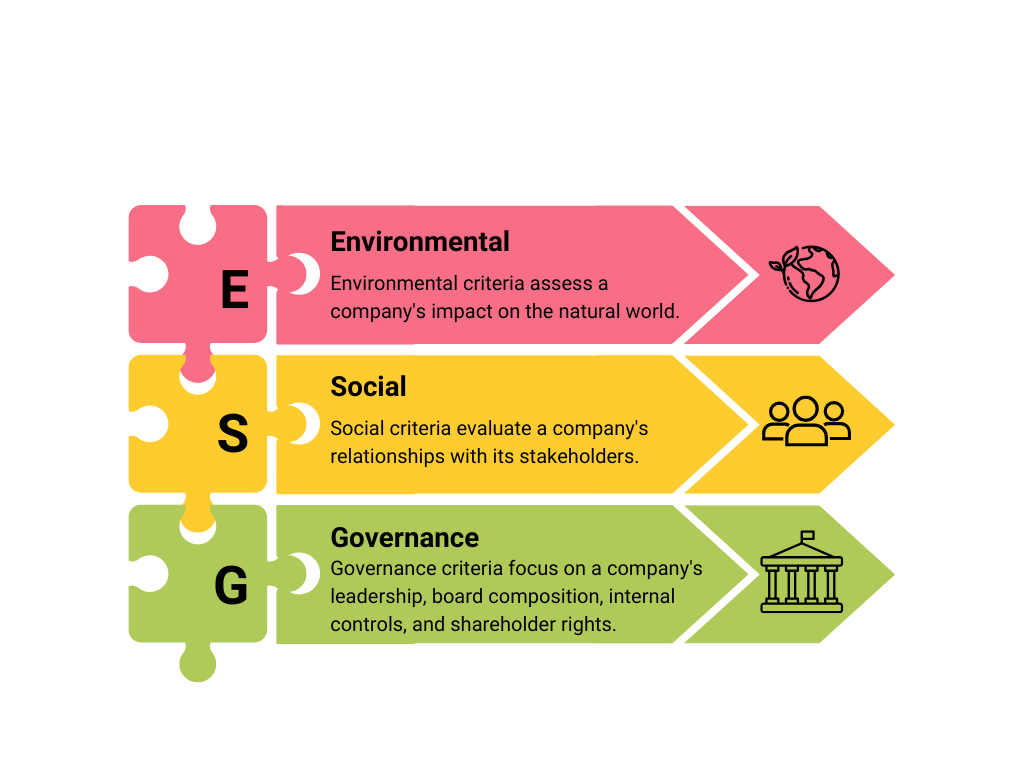

- Environmental (E): Environmental criteria assess a company’s impact on the natural world. This includes how a company manages its carbon footprint, waste, resource use, and environmental risks. Companies committed to environmental sustainability reduce their ecological footprint, enhance resource efficiency, and contribute to mitigating climate change.

- Social (S): Social criteria evaluate a company’s relationships with its stakeholders, including employees, customers, suppliers, and the communities it operates in. This encompasses labor practices, diversity and inclusion, human rights, community engagement, and customer satisfaction. Companies that prioritize social responsibility foster positive relationships and promote ethical practices, ultimately building a stronger societal foundation.

- Governance (G): Governance criteria focus on a company’s leadership, board composition, internal controls, and shareholder rights. Good governance ensures that a company operates with integrity, transparency, and accountability. Effective governance practices build trust, prevent corruption, and align company interests with those of stakeholders.

The Synergy of ESG Components

- Holistic Risk Management: Integrating E, S, and G criteria allows companies to identify and mitigate a broader range of risks. For example, environmental risks can impact social factors like community health, and governance failures can exacerbate environmental and social issues. A holistic approach ensures comprehensive risk management.

- Enhanced Reputation and Trust: Companies that excel in all three ESG areas build stronger reputations and trust among stakeholders. Environmental stewardship, social responsibility, and strong governance practices signal to investors, customers, and employees that a company is committed to ethical and sustainable practices. This trust enhances brand loyalty and attracts long-term investment.

- Employee Engagement and Retention: ESG factors have become important criteria for people entering the workforce. Employees who feel their company is making a positive difference in the world are more engaged, innovative, and likely to not only stay with their current employer but also build a long-term career there.

- Long-Term Sustainability: Sustainability is not just about environmental impact; it’s also about social equity and ethical governance. Companies that integrate ESG criteria are better positioned for long-term success. Sustainable environmental practices, fair social policies, and robust governance structures contribute to the overall resilience and longevity of a business.

- Stakeholder Alignment: ESG criteria ensure that a company’s actions align with the interests of all stakeholders, including shareholders, employees, customers, and the community. This alignment promotes a balance between profitability and positive societal impact, leading to more inclusive and equitable growth.

- Regulatory Compliance and Innovation: Adhering to ESG standards helps companies stay ahead of regulatory requirements and industry trends. This proactive approach fosters innovation, as companies develop new technologies and practices that meet environmental standards, address social issues, and enhance governance frameworks.

- Investor Appeal: Investors are increasingly integrating ESG criteria into their decision-making processes. Companies with strong ESG performance are seen as lower-risk and more sustainable investments. This investor confidence leads to better access to capital and more stable financial performance.

Conclusion

The integration of Environmental, Social, and Governance criteria creates a comprehensive framework for evaluating a company’s ethical and sustainable impact. Each component is essential, but their collective power drives transformative change. By prioritizing ESG criteria, companies can manage risks more effectively, build trust, ensure long-term sustainability, align stakeholder interests, foster innovation, and attract investment.

ESG is more than just a set of guidelines; it’s a holistic approach to responsible business that addresses the complex interconnections between environmental, social, and governance factors. Embracing ESG criteria is crucial for creating a better, more sustainable future for businesses and society alike.

Visit our website at https://envisionrise.com.