Unlocking Niche Market Potential: Boosting Customer Awareness Through Education

Unlocking Niche Market Potential: Boosting Customer Awareness Through Education

Insights from Envision RISE and a Colorado Kava Bar's Journey (part 2)

By Staci Hegarty, M.Ed.

Offering education to customers is nothing new. Companies like Apple have been doing it for years, which not only allows customers to get the best experience with the product but encourages customer retention. Most people are comfortable admitting that they need help to truly understand new technology and happily engage with the education that is offered. We can’t avoid technology, which means it is in our best interest to learn about it.

Other industries also need to engage their customers in education but have a bigger challenge in getting customers to accept that education. Niche businesses, such as the Colorado kava bar Envision RISE has been working with, may have products that are not mainstream but popular with their existing market. But, because general awareness is uncommon in a wider community, expansion to new customers is stifled. Even those who have heard of kava, for example, may not know much about it, they draw inaccurate conclusions about the product or the typical consumer This is particularly true for businesses that are part of the natural or alternative wellness industry. Massage, cold plunge, and even cannabis may be known products and services, but their potential benefits are not mainstream.

Knowledge gaps can be daunting. Newcomers might experience anxiety and hesitate to ask questions for fear of appearing uninformed. When your product or service is not well understood, it is important to offer education about it to openly welcome and encourage curiosity. In the case of the kava bar, this is how they have approached growing their customer base through education, using their website, social media, and interactions with staff:

1. Start with the Basics

Many people are unfamiliar with kava, so begin by explaining what it is. Share its history, cultural significance, and traditional preparation methods. Remove any stigma. For example:

“Kava is made from the root of the Piper methysticum plant, which has been used for centuries in Pacific Island ceremonies to promote relaxation and social bonding.”

2. Highlight the Benefits

Educate customers on kava’s primary benefits, such as its ability to reduce stress, promote relaxation, and improve focus. Explain that kava works by interacting with the brain’s GABA receptors to create a calming effect without impairing mental clarity. For some people, kava has become a method of harm reduction, replacing drugs and alcohol.

3. Discuss Safe Consumption

Help customers understand the importance of responsible kava use. Provide guidance on dosage, potential side effects, and contraindications. For example:

“Start with a small serving, as the effects of kava can vary. Avoid combining it with alcohol or certain medications and consult a healthcare provider if you have liver concerns.”

4. Offer Tasting Events

One of the best ways to educate customers is through experience. Host tasting events where they can try different types of kava and learn about their unique flavors and effects. Use this opportunity to share tips on preparation methods, such as traditional brewing or instant kava options.

5. Create Educational Content

Leverage blogs, videos, and social media posts to share valuable information about kava. Some options are:

- “Kava: The Ultimate Guide to this Traditional Yet Trendy Beverage” (blog)

- Community events that bring in new customers, such as yoga sessions and improv classes

- Highlighting community service work

6. Provide Trusted Resources

Empower customers to learn more by offering links to scientific studies, kava organizations, or expert interviews. This builds trust and credibility while showing your commitment to transparency.

7. Engage Your Community

Encourage feedback and discussions. Create a space—whether online or in-store—where customers can share their experiences, ask questions, and learn from each other. Events in your in-store space are ideal for building community and sharing experiences.

8. Expand Your Audience

Teaching a diverse audience about how kava can fit into and complement their lives involves highlighting its versatility and benefits in various contexts. For those with busy schedules, kava can be a soothing natural way to unwind after a hectic day. Fitness enthusiasts might appreciate kava’s muscle-relaxing properties post-workout. Socially, kava can be a healthy, non-alcoholic beverage option for gatherings, fostering connections without the side effects of alcohol.

The Value Proposition: A Wider View of User Experience

Education can become a pivotal element of the value proposition, seamlessly blending into the user experience of the product. By offering educational resources, tutorials, and guides, consumers gain confidence and proficiency in using the product. This not only enhances their overall experience but also builds a deeper connection with the brand. Educated users are more likely to appreciate the full range of features, leading to higher satisfaction and loyalty. Moreover, they can become brand advocates, sharing their knowledge and positive experiences with others. Incorporating education into the product experience ensures that consumers feel supported, informed, and empowered, ultimately driving long-term success for the product and the brand.

Crafting a tactical strategy to boost brand awareness and pique curiosity can significantly broaden your audience and cater to diverse user perspectives. Seamlessly integrating product education into all facets of your business, inside and out, can be the catalyst for growth.

Visit our website at https://envisionrise.com.

Finding the Sweet Spot: A Workforce Centric Culture

Finding the Sweet Spot: A Workforce Centric Culture

Insights from Envision RISE and a Colorado Kava Bar's Journey

By Staci Hegarty, M.Ed.

A business that thrives on a workforce-centric culture reaps the benefits of engaged, motivated, and loyal employees, which can lead to enhanced innovation, productivity, and overall success. However, to maintain and sustain this positive environment, it is crucial to balance this with the right level of structure. Effective organizational frameworks, clear policies, and strategic planning ensure that the culture is not only preserved but also adaptable to future challenges. Structured processes help in setting expectations, maintaining consistency, and providing a roadmap for growth, allowing the business to remain focused on long-term objectives while fostering a culture that values and supports its workforce. This balance between a supportive culture and robust structure is essential for achieving lasting success and resilience in a dynamic business landscape.

Envision RISE partners with a diverse range of organizations to strategically focus on the people who drive their success. This often involves gathering employee feedback, which commonly reflects a desire for greater care and consideration from the company. We primarily engage in human capital management, aiming to provide employees with opportunities for growth, validation, and appreciation. Our efforts may include enhancing human resource management through improved benefits, pay equity, and thorough policy reviews. Additionally, we support the establishment of Employee Resource Groups, mentorship programs, and succession planning. All these initiatives are designed to foster a culture that values the workforce and promotes innovation and engagement.

In the Beginning…

A few months ago, we partnered with a Colorado-based kava bar, finding ourselves in a unique situation where the organization already had the culture that many others aspire to achieve. However, they needed assistance with strategic planning, leadership, and structure. Kava, derived from the roots of a plant grown in the South Pacific, is brewed into a tea known for its relaxing properties. It is used in some tribal cultures as medicine and in religious ceremonies. Kava is unregulated, legal in all 50 states, and has sedative and psychotropic effects. Kava bars are gaining popularity, offering the social experience of a traditional bar but with the calming effects of kava instead of alcohol. Many of these bars focus on community, hosting events like meditation sessions, community service projects, and art classes.

Creating an Employee Centric Culture

The employee survey resulted in an uncommon response: employees expressed genuine love for their supportive and compassionate work environment. They praised the leadership for diverging from typical corporate norms, feeling “seen” and accepted not only by coworkers and leaders but also by customers. It seemed like an ideal workplace! However, there were notable concerns: employees felt there was a lack of direction and structure from leadership, desired clarity on policies and regulations, and voiced worries about the lack of professionalism from some coworkers.

In other words, the absence of structured guidelines was becoming detrimental. Fortunately, a newly implemented inventory system was already showing positive results, with less product loss and more consistent stock availability. Leadership had started introducing new staff policies and expanded the organizational chart to include managers. Previously, all employees reported directly to the three directors, which was overwhelming and led to employees seeking multiple answers for the same query. There were concerns that introducing a managerial layer might dilute the kava bars’ strong sense of community.

Maintaining the Culture that Thrives

Envision RISE faced a critical question: “How can we help them establish structure and accountability without undermining their culture?” Their culture IS their success. Customers come not just for a quick drink, but to connect and build relationships. Staff members become trusted advisors, providing emotional support and guidance along with kava-related advice. They know their regulars personally, beyond just their usual drink orders.

While this strong sense of community is generally positive, it presents challenges when issues arise. It’s not as simple as refusing service and asking a problematic customer to leave. The staff genuinely cares about their customers and struggles with the idea of excluding someone from the community. This same struggle applies to disciplining staff members. However, allowing disruptive behavior from customers or staff isn’t compassionate; it’s detrimental to both the culture and the business. Establishing clear guidelines and accountability measures is crucial to maintaining a supportive environment and ensuring the organization’s long-term success.

Finding the Sweet Spot

Striking the perfect balance between a workforce-centric culture and effective organizational structure is essential for sustainable success. By implementing clear guidelines and accountability measures, businesses can ensure a supportive environment that fosters employee engagement, innovation, and productivity.

At Envision RISE, we believe that valuing and supporting employees not only drives individual success but also contributes to the overall prosperity of the organization. As we continue to develop and implement right-sized policies, training programs, and strategic initiatives, our goal is to build businesses that give back to their communities and thrive. Culture is NOT enough.

Join us in crafting a future where organizational culture and structure coexist harmoniously, leading to enduring success and a passionate, engaged workforce. Together, we can create a workplace environment that celebrates its people and builds a foundation for lasting growth and purpose.

Let us join you on your journey of developing the” sweet spot” of fit for purpose guidelines, structures, and policies that not only respect the culture of an organization but also aim to strengthen and celebrate it. We employ right-sized training, strategic hiring, career-pathing, continual feedback, and policy implementation to build a business focused on giving back to the community.

Visit our website at https://envisionrise.com.

Employee Retention in Non-Traditional Industries: A Focus on Cannabis

Employee Retention in Non-Traditional Industries: A Focus on Cannabis

By Staci Hegarty, M.Ed.

Employee retention is a growing challenge across many industries, but it’s particularly pressing in non-traditional sectors like cannabis. With the rapid growth and ever-evolving nature of the cannabis industry, businesses often find themselves facing high turnover rates. In fact, recent reports show that turnover in the cannabis sector can reach as high as 55%, a significant concern for companies striving to build strong, long-term teams. Turnover is having a significant impact on the bottom line. For example, if a dispensary has 10 employees making an average of $19 an hour, a 55% turnover rate can translate into an annual turnover cost of nearly $80,000.

But why is retention so difficult in industries like cannabis, and what can employers do to keep their best talent?

- The Nature of the Industry

Cannabis is still a relatively young industry, often operating in states with fluctuating regulations and a rapidly changing market. For many workers, this can mean job instability, limited growth opportunities, and challenges related to unclear career paths. Additionally, the stigma surrounding cannabis—despite growing acceptance—can also create barriers to retention for employees who might feel their career in the sector isn’t as secure or respected as in more traditional fields.

- Strategic Hiring and Onboarding

When faced with high turnover, it is tempting to simply get the position filled and put the employee too work as quickly as possible. Prioritizing thoughtful hiring and implementing a robust onboarding program is the first step to retaining employees. A longer onboarding process means that employees reach full productivity more than 30% faster than employees who are onboarded briefly or not at all. The repetitive cycle of onboarding and training new employees is not only costly but also time-consuming, diverting valuable resources from other critical business activities.

The lack of transfer of business best practices and tribal knowledge, often confined to the owner’s head, can hinder effective decision-making and customer focus. Maintaining continuity and preserving institutional knowledge are vital to sustaining growth and stability.

- The Importance of Company Culture

In industries like cannabis, a strong, inclusive company culture can make all the difference. Employees are more likely to stay when they feel valued, heard, and part of a mission they believe in. Cannabis companies that foster an environment of trust, transparency, and support are better positioned to build loyalty among their teams. Investing in employee engagement, regular feedback, and recognition can go a long way toward building this type of culture.

Investing in employee engagement is another critical factor. Regular feedback sessions help employees understand their performance and areas for improvement, while also giving them a platform to voice their ideas and concerns.

- Career Development and Growth Opportunities

In fast-growing sectors like cannabis, employees want to know they have room to grow. Offering clear career development paths, opportunities for advancement, and training programs can help employees feel invested in their long-term success. Companies that prioritize personal and professional growth—whether through mentorship, certifications, or leadership programs—tend to see higher retention rates.

- Competitive Compensation and Benefits

While passion for the product and the mission is important, employees still need competitive wages and benefits to stay engaged. Cannabis businesses must consider offering competitive compensation, flexible working conditions, and benefits like health insurance or retirement plans to keep their workforce motivated and satisfied. In a highly competitive job market, it’s essential to show employees that their contributions are valued.

In addition, recognition programs that celebrate achievements, both big and small, boost morale and motivation. When employees feel appreciated and acknowledged for their hard work, they are more likely to stay committed to the company.

- Work-Life Balance

With the demands of the cannabis industry, from harvests to compliance requirements, employees can easily experience burnout. Encouraging a healthy work-life balance is essential to preventing turnover. Flexible schedules, remote work options, and wellness programs can all play a key role in keeping employees happy and reducing stress.

Conclusion

In industries like cannabis, where the workforce is often young, passionate, and diverse, employee retention is both a challenge and an opportunity. By focusing on creating a positive, supportive culture, offering growth opportunities, and ensuring competitive compensation, cannabis businesses can not only reduce turnover but also foster loyalty and long-term success. In a competitive market, the best employees aren’t just looking for a job—they’re looking for a place where they can grow and thrive. It’s up to employers to provide that space.

Ultimately, investing in employee retention ensures the stability and growth of the business, creating a competitive edge in the market. Retaining good talent is essential because each employee’s contribution boosts productivity, fosters community, and improves the quality of services offered, leading to loyal, returning customers.

Envision RISE understands the unique challenges of the cannabis industry and will work to create employee retention strategies that translate into cost reduction, greater employee engagement, and a positive customer experience.

Visit our website at https://envisionrise.com.

How Envision RISE Can Help Assess Your Organizations ESG Goals and Outline a Plan for Your Desired State

How Envision RISE Can Help Assess Your Organizations ESG Goals and Outline a Plan for Your Desired State

By Staci Hegarty, M.Ed.

Creating an effective ESG roadmap tailored to your organization’s future goals and objectives is a strategic journey, not a prescriptive checklist. Envision RISE can be a valuable partner in this process, offering expertise and tools to assess your current state, identify gaps, and develop a comprehensive plan to achieve your desired state.

Step-by-Step Approach with Envision RISE

- Assessment of Current State: Envision RISE collaborates with your organization to conduct a thorough assessment of your current ESG practices. This involves evaluating your environmental impact, social responsibilities, and governance structures to understand your starting point.

- Gap Analysis: Together with Envision RISE, you’ll conduct a gap analysis aligned with your goals and objectives. This analysis helps identify areas where your organization needs to improve to meet your ESG targets.

- Defining Action Plans: Envision RISE works with you to define both near-term and long-term action plans. These plans focus on quick wins and strategic initiatives that will drive your ESG goals forward.

- Socialization and Visibility Plan: Envision RISE outlines an internal and external socialization and visibility plan. This ensures that your ESG efforts are communicated effectively to all stakeholders, building trust and demonstrating your commitment to responsible business practices.

- Continuous Monitoring and Adaptation: Envision RISE helps establish key performance indicators (KPIs) to monitor your progress and adapt your strategies as needed. This dynamic approach ensures that your ESG roadmap remains relevant and effective over time.

Benefits of Partnering with Envision RISE

- Expertise and Experience: Envision RISE brings a wealth of knowledge and experience in ESG assessment and planning, helping you navigate the complexities of ESG integration.

- Tailored Solutions: Their services are customized to fit the unique needs of your organization, ensuring that your ESG roadmap is aligned with your specific goals and objectives.

- Comprehensive Support: From initial assessment to ongoing monitoring, Envision RISE provides comprehensive support throughout your ESG journey.

- Enhanced Credibility: Partnering with a reputable ESG-focused organization like Envision RISE enhances your credibility with stakeholders, investors, and regulatory bodies.

Conclusion

Creating an ESG roadmap focused on your future organizational goals and objectives is a strategic journey that requires expertise, collaboration, and a tailored approach. Envision RISE offers the tools and support needed to assess your current state, identify gaps, and develop a comprehensive plan to achieve your desired state. By partnering with Envision RISE, you can build a resilient and sustainable business that aligns with your values and drives long-term success.

Visit our website at https://envisionrise.com.

The Vital Role of Governance in ESG (4-Part Series)

The Vital Role of Governance in ESG

Part 4 of a 4-Part Series

By Staci Hegarty, M.Ed.

In recent years, Environmental, Social, and Governance (ESG) criteria have gained significant traction in shaping how companies are evaluated and held accountable. While the environmental (E) and social (S) aspects often receive the most attention, the governance (G) component is equally critical in driving sustainable and ethical business practices. Here’s why governance should never be overlooked in the ESG equation.

What is Governance in ESG?

Governance refers to the system of rules, practices, and processes by which a company is directed and controlled. It encompasses everything from executive leadership and board composition to company policies, internal controls, and shareholder rights. Good governance ensures that a company is managed in the best interests of all stakeholders, including shareholders, employees, customers, and the broader community.

Four Pillars of Good Governance

- Transparency: Companies with strong governance are transparent in their operations, providing clear, accurate, and timely information to stakeholders. This includes financial performance, business practices, and risks. Transparency builds trust and enables stakeholders to make informed decisions.

- Accountability: Good governance means that leaders are held accountable for their actions. This involves clear delineation of responsibilities, regular performance reviews, and mechanisms to address misconduct. Accountability ensures that decisions are made in the best interest of the company and its stakeholders.

- Fairness: Equitable treatment of all stakeholders is a cornerstone of good governance. This means fair practices in hiring, promotions, and dealings with suppliers and customers. Fairness helps build a positive corporate culture and strengthens the company’s reputation.

- Responsibility: Companies with robust governance frameworks take responsibility for their impact on society and the environment. This includes ethical business practices, compliance with laws and regulations, and proactive risk management.

Why Governance Matters

- Risk Management: Effective governance helps identify, mitigate, and manage risks before they become problematic. By having robust policies and procedures in place, companies can avoid scandals, legal issues, and financial losses.

- Investor Confidence: Investors are increasingly looking at governance practices as part of their investment decisions. Companies that demonstrate strong governance are more likely to attract and retain investors, as they are perceived as less risky and more reliable.

- Long-term Success: Good governance fosters a culture of integrity and ethical behavior, which is essential for long-term success. It promotes sustainable business practices that not only benefit the company but also contribute to the well-being of society and the environment.

- Regulatory Compliance: As regulations become more stringent, companies with strong governance are better positioned to comply with legal requirements. This reduces the risk of fines, penalties, and reputational damage.

- Corporate Reputation: Companies known for their good governance are more likely to be trusted by customers, employees, and the public. A strong reputation can be a significant competitive advantage, attracting talent, fostering customer loyalty, and enhancing overall business performance.

Conclusion

While environmental and social criteria are vital for assessing a company’s ESG performance, governance is the glue that holds everything together. It’s the framework that ensures ethical behavior, accountability, and transparency. By prioritizing good governance, companies not only mitigate risks but also position themselves for sustainable growth and success in a rapidly evolving business landscape.

Governance isn’t just a box to tick in the ESG checklist; it’s the foundation upon which a resilient and responsible business is built. Let’s give governance the attention it deserves in our pursuit of a sustainable and ethical future.

Visit our website at https://envisionrise.com.

The Critical Role of Environmental Considerations in ESG (4-Part Series)

The Critical Role of Environmental Considerations in ESG

Part 2 of a 4-Part Series

By Staci Hegarty, M.Ed.

The concept of Environmental, Social, and Governance (ESG) criteria has become a cornerstone in evaluating a company’s ethical impact and sustainability. While each component of ESG is essential, the environmental (E) aspect demands urgent attention in our current global context. Here’s why environmental considerations are paramount and how they shape the future of businesses and the planet.

What Does the ‘E’ in ESG Entail?

Environmental criteria involve assessing how a company’s operations impact the natural world. This includes a range of factors such as energy use, waste management, pollution, natural resource conservation, and the treatment of animals. It also covers the extent to which a company mitigates environmental risks and implements sustainable practices.

Key Areas of Environmental Focus

- Climate Change and Carbon Footprint: Companies are increasingly measured by their efforts to reduce greenhouse gas emissions. A smaller carbon footprint not only signifies environmental responsibility but also positions companies as leaders in the fight against climate change. This is crucial for long-term sustainability and aligning with global targets like the Paris Agreement.

- Resource Management: Efficient use of natural resources like water, minerals, and timber is vital. Companies need to adopt practices that minimize resource depletion and promote regeneration. Sustainable resource management reduces operational costs and ensures the longevity of essential resources.

- Waste and Pollution: Effective waste management and pollution control are critical. Companies must strive to minimize their waste output and manage it responsibly. This includes reducing plastic use, managing chemical waste, and ensuring safe disposal practices. Pollution control helps preserve ecosystems and protect public health.

- Biodiversity and Land Use: Protecting biodiversity involves ensuring that business practices do not harm wildlife or natural habitats. Sustainable land use practices prevent deforestation, soil degradation, and loss of biodiversity. Companies that prioritize biodiversity are seen as stewards of the environment.

Why the Environmental Component Matters

- Risk Mitigation: Ignoring environmental considerations can lead to significant risks, including regulatory fines, cleanup costs, and damage to a company’s reputation. Proactively addressing environmental risks can mitigate these potential issues. Risk mitigation may also have a role in determining future products. If a component of a product becomes scarce, it will be necessary to innovate solutions to revise or replace the need for that component.

- Investor Attraction: Investors are increasingly prioritizing sustainability. Companies with strong environmental practices attract more investment as they are perceived as lower risk and more future ready. Sustainable businesses are better positioned to adapt to changing regulations and market demands.

- Consumer Preference: Modern consumers are more environmentally conscious. They prefer to support companies that demonstrate a commitment to sustainability. This shift in consumer behavior drives companies to adopt greener practices to maintain and grow their market share.

- Long-term Sustainability: Environmental sustainability ensures that a company can continue its operations without depleting the resources it relies on. This long-term perspective is essential for a company’s survival and growth in an increasingly resource-constrained world.

- Regulatory Compliance: Governments and international bodies are imposing stricter environmental regulations. Companies that adhere to these regulations avoid legal penalties and enhance their credibility. Staying ahead of regulatory requirements ensures smooth operations and can provide a competitive edge.

Conclusion

Incorporating environmental criteria into business practices is not just an ethical imperative but also a strategic one. Companies that prioritize environmental sustainability position themselves as leaders in their industry, attract conscientious investors, and appeal to a growing base of eco-aware consumers.

The ‘E’ in ESG is critical for building a resilient, future-ready business that contributes positively to the planet. By integrating robust environmental practices, companies can drive sustainable growth and make a meaningful impact on global environmental challenges.

It’s time we give environmental sustainability the attention it deserves in our business strategies and operations. The future of our planet depends on it.

Visit our website at https://envisionrise.com.

Unlocking Organizational Potential: The Benefits of DiSC for Innovation, Leadership, and Fluency

Unlocking Organizational Potential: The Benefits of DiSC for Innovation, Leadership, and Fluency

By Staci Hegarty, M.Ed.

In the world of responsible investing and corporate accountability, Environmental, Social, and Governance (ESG) criteria have become vital metrics. While each component—environmental, social, and governance—holds significant value individually, their collective strength is what truly transforms businesses and communities. Here’s why the E, S, and G belong together in ESG.

As we navigate a flexible workforce and a constantly evolving environment, it’s vital to continually refine our work methods to stay agile. Let’s return to the basics of efficient and effective communication. We need to remember the foundations of teamwork, appreciate our differences, and learn to operate like a well-oiled machine. Companies striving for excellence in their innovation teams, leadership alignment, and organizational fluency often turn to tools and methodologies that foster better communication and understanding. One such tool that has proven invaluable is the DiSC assessment.

What is DiSC?

DiSC is a behavioral assessment tool that provides insights into an individual’s personality traits and behaviors. It focuses on four primary dimensions: Dominance (D), Influence (I), Steadiness (S), and Conscientiousness (C). By understanding these dimensions, organizations can tailor their approaches to better align with the strengths and preferences of their teams.

Benefits of DiSC for Innovation Teams

- Enhanced Collaboration: Innovation thrives on collaboration. DiSC helps team members understand each other’s communication styles, leading to more effective and harmonious interactions. When team members know how to approach and engage with one another, they can leverage their collective strengths to drive creative solutions.

- Improved Problem-Solving: Diverse perspectives are essential for innovation. DiSC encourages teams to appreciate different viewpoints, fostering an environment where diverse ideas can be explored. This leads to more robust problem-solving as teams combine their unique insights.

- Increased Self-Awareness: DiSC assessments help individuals gain a deeper understanding of their own behaviors and tendencies. This self-awareness enables team members to recognize their strengths and areas for improvement, allowing them to contribute more effectively to innovation projects.

Benefits of DiSC for Leadership Alignment

- Better Communication: Effective leadership hinges on clear and empathetic communication. DiSC provides leaders with a framework to understand their communication preferences and those of their team members. This understanding helps bridge communication gaps and fosters a more cohesive leadership team.

- Tailored Leadership Development: DiSC assessments identify individual leadership styles and areas for growth. Organizations can use this information to create personalized development plans that align with each leader’s strengths and opportunities, resulting in a more competent and aligned leadership team.

- Enhanced Conflict Resolution: Conflict is inevitable in any organization, but how it’s managed can make all the difference. DiSC equips leaders with the tools to approach conflicts constructively, understanding the underlying behavioral dynamics and finding resolutions that maintain team harmony.

Benefits of DiSC for Organizational Fluency

- Streamlined Processes: Organizational fluency refers to the ease with which an organization operates. DiSC helps streamline processes by promoting better understanding and communication across all levels. When teams understand each other’s working styles, processes become more efficient and effective.

- Strengthened Company Culture: A positive company culture is built on mutual respect and understanding. DiSC fosters these qualities by encouraging employees to appreciate the diversity of behaviors within the organization. This strengthens the overall culture, making it more inclusive and cohesive.

- Enhanced Employee Engagement: Employees who feel understood and valued are more likely to be engaged and motivated. DiSC assessments help create an environment where employees’ contributions are recognized, leading to higher job satisfaction and retention rates.

- Reduced Waste with Efficient Communications: Effective communication is key to reducing misunderstandings and inefficiencies. DiSC assessments help teams communicate more effectively, ensuring that messages are clear and understood. This efficiency reduces wasted time and resources, allowing teams to focus on innovation and productivity.

Conclusion

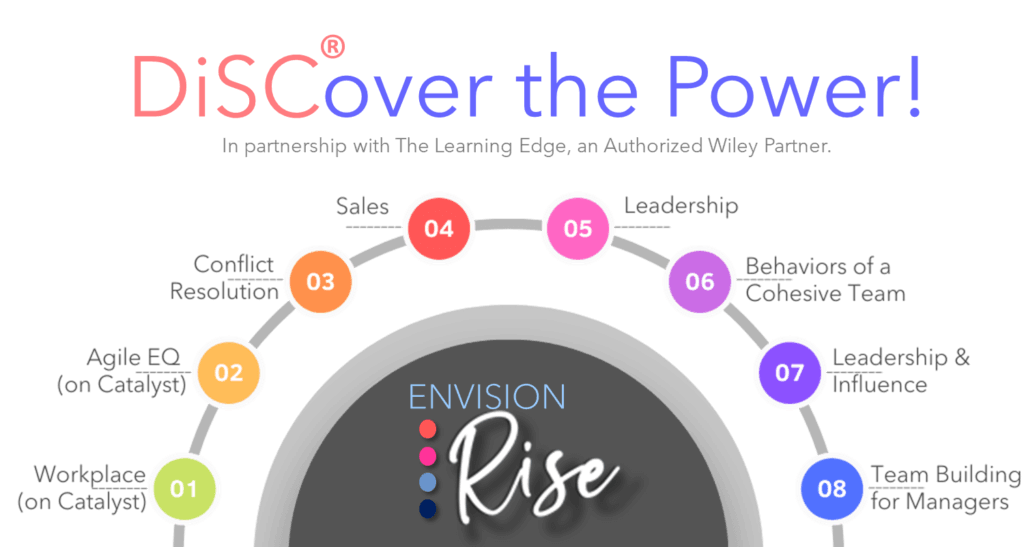

Envision RISE training offers an 8-course DiSC assessment designed to be the catalyst for unlocking the most efficient and effective ways of working within your teams. By utilizing this comprehensive program, your organization can foster better communication, enhance collaboration, and improve overall team dynamics. The DiSC assessment helps team members understand their own behavior styles as well as those of their colleagues, leading to more harmonious and productive interactions. This understanding is crucial for creating a well-oiled machine where everyone’s strengths are leveraged, and differences are appreciated. With Envision RISE, you can set your teams on a path to greater efficiency and success.

Visit our website at https://envisionrise.com.

Why Environmental, Social, and Governance (ESG) Criteria Belong Together (4-Part Series)

Why Environmental, Social, and Governance (ESG) Criteria Belong Together

Part 1 of a 4-Part Series

By Staci Hegarty, M.Ed.

In the world of responsible investing and corporate accountability, Environmental, Social, and Governance (ESG) criteria have become vital metrics. While each component—environmental, social, and governance—holds significant value individually, their collective strength is what truly transforms businesses and communities. Here’s why the E, S, and G belong together in ESG.

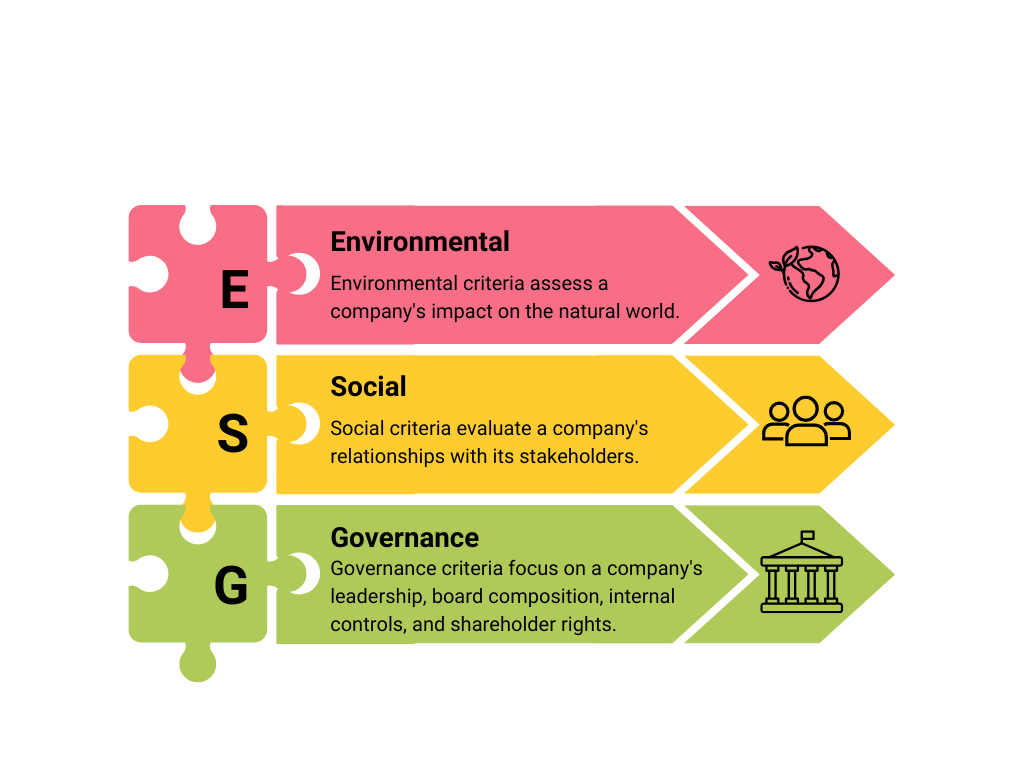

The Interconnected Nature of ESG

- Environmental (E): Environmental criteria assess a company’s impact on the natural world. This includes how a company manages its carbon footprint, waste, resource use, and environmental risks. Companies committed to environmental sustainability reduce their ecological footprint, enhance resource efficiency, and contribute to mitigating climate change.

- Social (S): Social criteria evaluate a company’s relationships with its stakeholders, including employees, customers, suppliers, and the communities it operates in. This encompasses labor practices, diversity and inclusion, human rights, community engagement, and customer satisfaction. Companies that prioritize social responsibility foster positive relationships and promote ethical practices, ultimately building a stronger societal foundation.

- Governance (G): Governance criteria focus on a company’s leadership, board composition, internal controls, and shareholder rights. Good governance ensures that a company operates with integrity, transparency, and accountability. Effective governance practices build trust, prevent corruption, and align company interests with those of stakeholders.

The Synergy of ESG Components

- Holistic Risk Management: Integrating E, S, and G criteria allows companies to identify and mitigate a broader range of risks. For example, environmental risks can impact social factors like community health, and governance failures can exacerbate environmental and social issues. A holistic approach ensures comprehensive risk management.

- Enhanced Reputation and Trust: Companies that excel in all three ESG areas build stronger reputations and trust among stakeholders. Environmental stewardship, social responsibility, and strong governance practices signal to investors, customers, and employees that a company is committed to ethical and sustainable practices. This trust enhances brand loyalty and attracts long-term investment.

- Employee Engagement and Retention: ESG factors have become important criteria for people entering the workforce. Employees who feel their company is making a positive difference in the world are more engaged, innovative, and likely to not only stay with their current employer but also build a long-term career there.

- Long-Term Sustainability: Sustainability is not just about environmental impact; it’s also about social equity and ethical governance. Companies that integrate ESG criteria are better positioned for long-term success. Sustainable environmental practices, fair social policies, and robust governance structures contribute to the overall resilience and longevity of a business.

- Stakeholder Alignment: ESG criteria ensure that a company’s actions align with the interests of all stakeholders, including shareholders, employees, customers, and the community. This alignment promotes a balance between profitability and positive societal impact, leading to more inclusive and equitable growth.

- Regulatory Compliance and Innovation: Adhering to ESG standards helps companies stay ahead of regulatory requirements and industry trends. This proactive approach fosters innovation, as companies develop new technologies and practices that meet environmental standards, address social issues, and enhance governance frameworks.

- Investor Appeal: Investors are increasingly integrating ESG criteria into their decision-making processes. Companies with strong ESG performance are seen as lower-risk and more sustainable investments. This investor confidence leads to better access to capital and more stable financial performance.

Conclusion

The integration of Environmental, Social, and Governance criteria creates a comprehensive framework for evaluating a company’s ethical and sustainable impact. Each component is essential, but their collective power drives transformative change. By prioritizing ESG criteria, companies can manage risks more effectively, build trust, ensure long-term sustainability, align stakeholder interests, foster innovation, and attract investment.

ESG is more than just a set of guidelines; it’s a holistic approach to responsible business that addresses the complex interconnections between environmental, social, and governance factors. Embracing ESG criteria is crucial for creating a better, more sustainable future for businesses and society alike.

Visit our website at https://envisionrise.com.

Why the UAE is Investing in Sustainability

Why the UAE is Investing in Sustainability

By Michael Benning, Executive Director True North Calibration at IpX

The United Arab Emirates (UAE) is investing heavily in sustainability for several strategic, economic, and environmental reasons. The Emirates’ oil and natural gas reserves are the world’s sixth and seventh largest, respectively, and for more than three decades, oil and global finance drove the UAE’s economy. In 2008-09, the confluence of falling oil prices, collapsing real estate prices, and the international banking crisis hit the UAE especially hard. The country is becoming less reliant on oil and gas and is economically focusing investment into healthcare, education, and infrastructure.

Here are five reasons the UAE is prioritizing sustainability and the potential return on investment (ROI) for these efforts:

Reasons for Investing in Sustainability

- Perhaps most significantly and immediately pressing is economic diversification:

-

- Investing in sustainable industries helps diversify the economy and reduce vulnerability to oil price fluctuations.

- New economic sectors: Sustainability initiatives are opening up new sectors such as renewable energy, green technologies, and sustainable tourism, creating job opportunities and stimulating economic growth. Many of these sectors require highly skilled professionals.

- Environmental Concerns:

-

- Climate change mitigation: Like many coastal areas, the UAE is vulnerable to the impacts of climate change, including sea-level rise, but also extreme heat. Over the longer term, investing in sustainability is expected to mitigate these risks.

- Resource management: Sustainable practices improve water and energy management, obviously crucial in a region with limited natural freshwater resources.

Global Image and Leadership:

Global Image and Leadership:

-

- International standing: By leading in sustainability, the UAE can enhance its global reputation and influence. Hosting events like the World Expo 2020 with a strong sustainability theme helps project this image.

- Compliance with Global Agreements: The UAE is committed to international agreements like the Paris Agreement, which requires significant investments in reducing carbon emissions.

- Innovation and Technology:

-

- Research and Development: Investing in sustainability fosters innovation and technological advancements. Initiatives such as Masdar City are positioned as hubs for clean technology and innovation.

- Attracting Investment: Sustainable projects attract foreign investment and partnerships, further boosting the economy.

- Social Development:

-

- Improving Quality of Life: Sustainable urban planning, renewable energy projects, and environmental conservation contribute to a higher quality of life for residents.

- Health Benefits: Reducing pollution and improving environmental conditions have direct positive effects on public health.

Return on Investment (ROI)

Economic Returns:

- Increased Foreign Investment: A strong commitment to sustainability is expected to attract global investors prioritizing green projects.

- Job Creation: The development of sustainable industries creates new jobs – many of which require highly skilled professionals – and stimulates economic growth.

- Energy Savings: Investments in renewable energy sources including wind and solar reduce dependence on fossil fuels, translating to long-term cost savings.

Environmental Benefits:

Environmental Benefits:

- Reduced Emissions: Investments in clean energy and sustainable practices significantly reduce greenhouse gas emissions, helping to combat climate change.

- Resource Efficiency: Improved water and energy efficiency leads to cost savings and more sustainable resource management.

Social Returns:

- Improved Public Health: Cleaner air and water, along with green spaces, lead to better health outcomes and reduced healthcare costs.

- Enhanced Living Standards: Sustainable urban developments improve living conditions, making cities more livable and attractive.

Long-Term Stability:

- Resilience to Oil Price Volatility: By diversifying the economy, the UAE becomes less vulnerable to fluctuations in global oil prices.

- Future-Proofing: Investing in sustainability ensures the UAE is better prepared for future environmental and economic challenges.

Examples of UAE’s Sustainability Initiatives

- Sharjah Research, Technology and Innovation Park Free Zone (SRTI Park) was established in 2016 by royal decree and was mandated to develop and manage an innovation ecosystem that promotes Research and Development (R&D) and supports enterprise activities, utilizing the triple helix collaboration of industry, government, and academia.

- Masdar City: An ambitious project aiming to be one of the most sustainable cities in the world, focusing on renewable energy and sustainable urban planning.

- Noor Abu Dhabi: One of the world’s largest single-site solar projects, contributing significantly to the UAE’s renewable energy capacity.

- Dubai Clean Energy Strategy 2050: Aims to provide 75% of Dubai’s energy from clean sources by 2050.

IpX

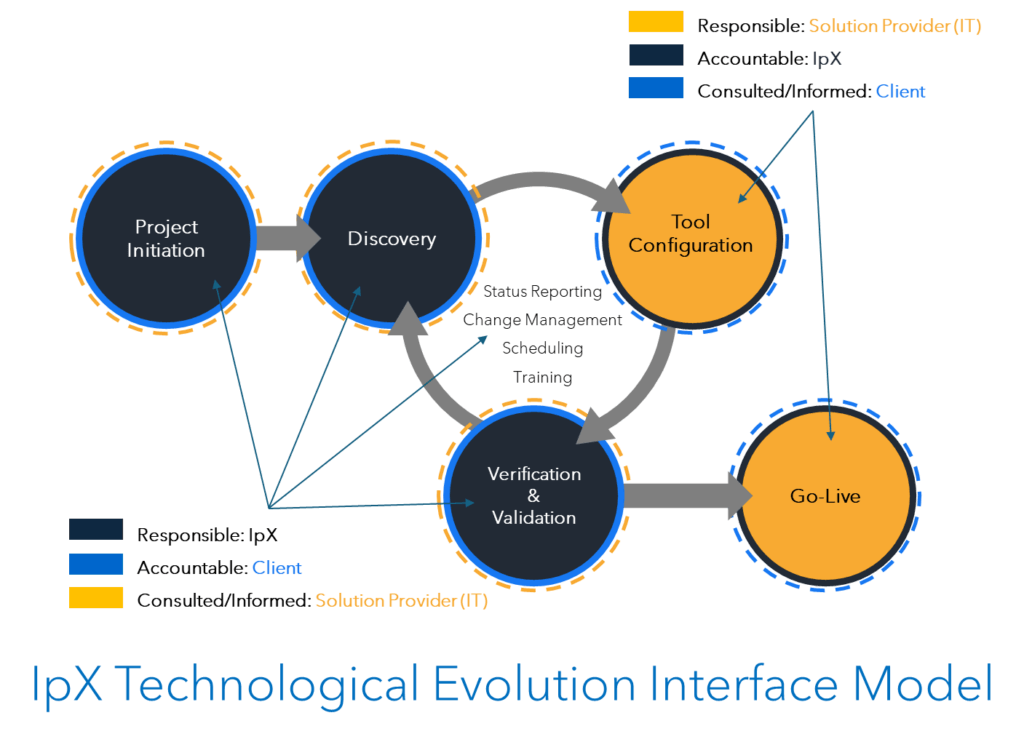

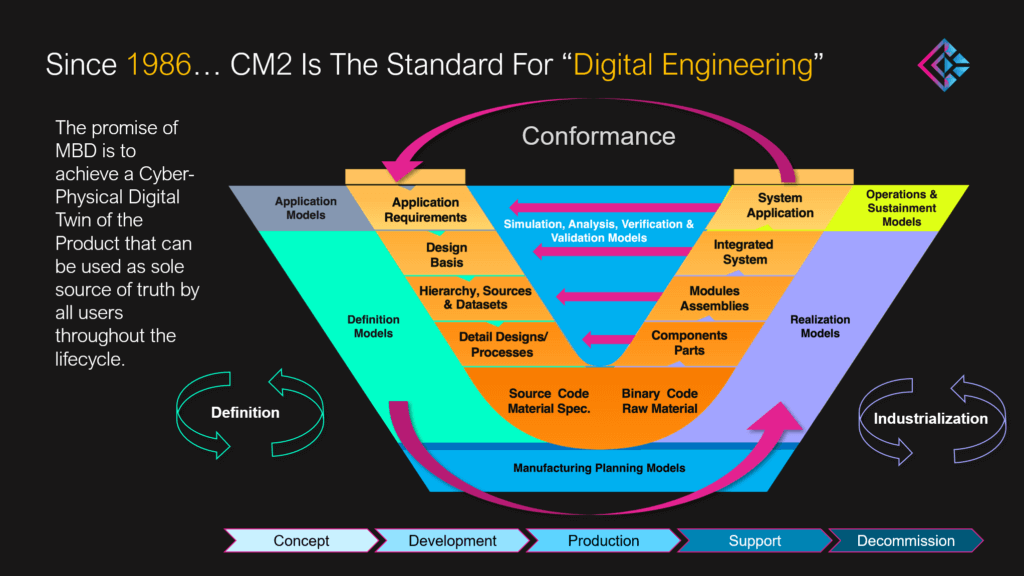

- To learn more about IpX, the “V-model”, or the Technological Evolution model, please visit ipxhq.com.

Who We Are…

The Envision RISE Human Strategy platform fulfills the needs of both the organization and the individual, going beyond traditional HR-centered initiatives. We build organizations that engage with the employee, the environment, and the community to encourage innovation and agility, with an eye toward greater engagement, ethical leadership, and sustainability.

Our Approach…

The RISE platform instills a novel way of thinking that focuses on fulfilling the needs of the individual and not simply an HR-centered initiative. This is an evolution from legacy Organizational Change Management (OCM) methods to a modern fit-for-purpose Organizational Evolution & Sustainability (OE&S) platform.

Services…

The RISE platform provides a voice to the individual and a framework critical to cultural sustainability, innovation and bottom-line enterprise efficiency. Through an ecosystem health survey & assessment, the RISE service model establishes clear objectives, concise indicators, and valid transformation plans that allow the enterprise to measure progress, ensure success, and continually improve.

Conclusion

The UAE’s investment in sustainability is driven by a strategic vision to diversify its economy, address environmental challenges, enhance its global standing, and improve the quality of life for its residents. The ROI on these investments is multifaceted, encompassing economic growth, environmental preservation, social benefits, and long-term stability. As these initiatives mature, they are expected to yield significant returns, both in financial terms and in the overall well-being of the nation.

Links:

UAE Sustainability Initiatives | EmiratesGBC

Masood M. Sharif Mahmood, CEO e&UAE

Bodour Al Qasimi, President of the American University of Sharjah

AGSIW | UAE: Norway’s Lessons for Economic Development and Sustainability

Visit our website at https://envisionrise.com.