Why Environmental, Social, and Governance (ESG) Criteria Belong Together

Part 1 of a 4-Part Series

By Staci Hegarty, M.Ed.

In the world of responsible investing and corporate accountability, Environmental, Social, and Governance (ESG) criteria have become vital metrics. While each component—environmental, social, and governance—holds significant value individually, their collective strength is what truly transforms businesses and communities. Here’s why the E, S, and G belong together in ESG.

The Interconnected Nature of ESG

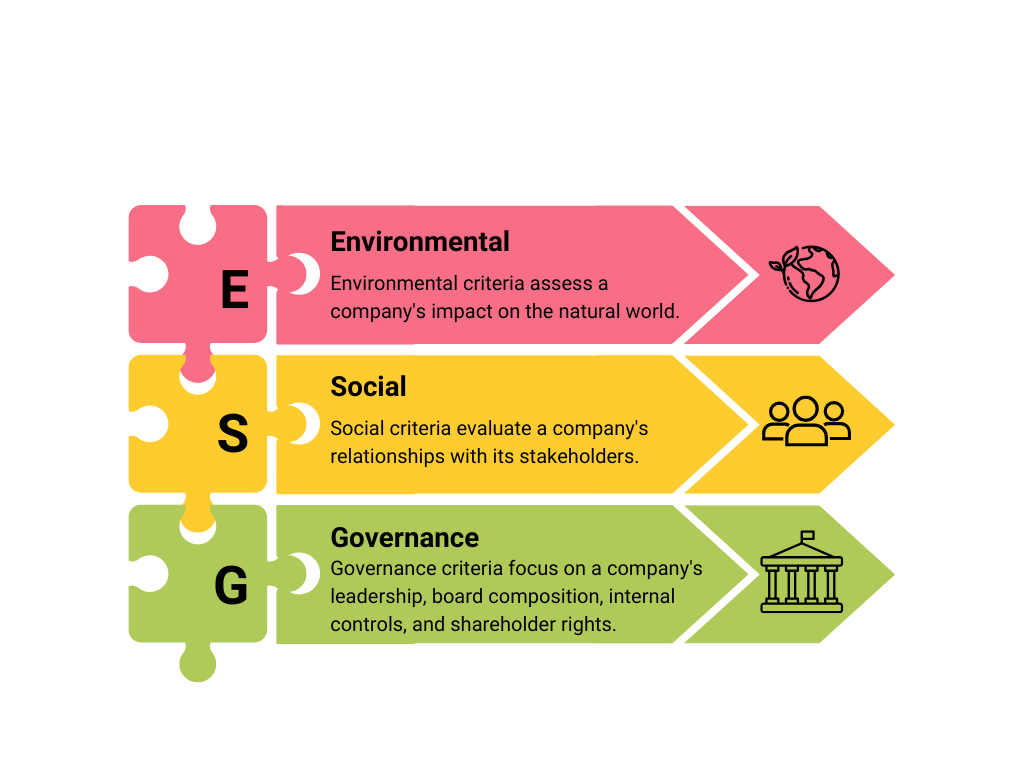

- Environmental (E): Environmental criteria assess a company’s impact on the natural world. This includes how a company manages its carbon footprint, waste, resource use, and environmental risks. Companies committed to environmental sustainability reduce their ecological footprint, enhance resource efficiency, and contribute to mitigating climate change.

- Social (S): Social criteria evaluate a company’s relationships with its stakeholders, including employees, customers, suppliers, and the communities it operates in. This encompasses labor practices, diversity and inclusion, human rights, community engagement, and customer satisfaction. Companies that prioritize social responsibility foster positive relationships and promote ethical practices, ultimately building a stronger societal foundation.

- Governance (G): Governance criteria focus on a company’s leadership, board composition, internal controls, and shareholder rights. Good governance ensures that a company operates with integrity, transparency, and accountability. Effective governance practices build trust, prevent corruption, and align company interests with those of stakeholders.

The Synergy of ESG Components

- Holistic Risk Management: Integrating E, S, and G criteria allows companies to identify and mitigate a broader range of risks. For example, environmental risks can impact social factors like community health, and governance failures can exacerbate environmental and social issues. A holistic approach ensures comprehensive risk management.

- Enhanced Reputation and Trust: Companies that excel in all three ESG areas build stronger reputations and trust among stakeholders. Environmental stewardship, social responsibility, and strong governance practices signal to investors, customers, and employees that a company is committed to ethical and sustainable practices. This trust enhances brand loyalty and attracts long-term investment.

- Employee Engagement and Retention: ESG factors have become important criteria for people entering the workforce. Employees who feel their company is making a positive difference in the world are more engaged, innovative, and likely to not only stay with their current employer but also build a long-term career there.

- Long-Term Sustainability: Sustainability is not just about environmental impact; it’s also about social equity and ethical governance. Companies that integrate ESG criteria are better positioned for long-term success. Sustainable environmental practices, fair social policies, and robust governance structures contribute to the overall resilience and longevity of a business.

- Stakeholder Alignment: ESG criteria ensure that a company’s actions align with the interests of all stakeholders, including shareholders, employees, customers, and the community. This alignment promotes a balance between profitability and positive societal impact, leading to more inclusive and equitable growth.

- Regulatory Compliance and Innovation: Adhering to ESG standards helps companies stay ahead of regulatory requirements and industry trends. This proactive approach fosters innovation, as companies develop new technologies and practices that meet environmental standards, address social issues, and enhance governance frameworks.

- Investor Appeal: Investors are increasingly integrating ESG criteria into their decision-making processes. Companies with strong ESG performance are seen as lower-risk and more sustainable investments. This investor confidence leads to better access to capital and more stable financial performance.

Conclusion

The integration of Environmental, Social, and Governance criteria creates a comprehensive framework for evaluating a company’s ethical and sustainable impact. Each component is essential, but their collective power drives transformative change. By prioritizing ESG criteria, companies can manage risks more effectively, build trust, ensure long-term sustainability, align stakeholder interests, foster innovation, and attract investment.

ESG is more than just a set of guidelines; it’s a holistic approach to responsible business that addresses the complex interconnections between environmental, social, and governance factors. Embracing ESG criteria is crucial for creating a better, more sustainable future for businesses and society alike.

Visit our website at https://envisionrise.com.