Why Environmental, Social, and Governance (ESG) Criteria Belong Together (4-Part Series)

Why Environmental, Social, and Governance (ESG) Criteria Belong Together

Part 1 of a 4-Part Series

By Staci Hegarty, M.Ed.

In the world of responsible investing and corporate accountability, Environmental, Social, and Governance (ESG) criteria have become vital metrics. While each component—environmental, social, and governance—holds significant value individually, their collective strength is what truly transforms businesses and communities. Here’s why the E, S, and G belong together in ESG.

The Interconnected Nature of ESG

- Environmental (E): Environmental criteria assess a company’s impact on the natural world. This includes how a company manages its carbon footprint, waste, resource use, and environmental risks. Companies committed to environmental sustainability reduce their ecological footprint, enhance resource efficiency, and contribute to mitigating climate change.

- Social (S): Social criteria evaluate a company’s relationships with its stakeholders, including employees, customers, suppliers, and the communities it operates in. This encompasses labor practices, diversity and inclusion, human rights, community engagement, and customer satisfaction. Companies that prioritize social responsibility foster positive relationships and promote ethical practices, ultimately building a stronger societal foundation.

- Governance (G): Governance criteria focus on a company’s leadership, board composition, internal controls, and shareholder rights. Good governance ensures that a company operates with integrity, transparency, and accountability. Effective governance practices build trust, prevent corruption, and align company interests with those of stakeholders.

The Synergy of ESG Components

- Holistic Risk Management: Integrating E, S, and G criteria allows companies to identify and mitigate a broader range of risks. For example, environmental risks can impact social factors like community health, and governance failures can exacerbate environmental and social issues. A holistic approach ensures comprehensive risk management.

- Enhanced Reputation and Trust: Companies that excel in all three ESG areas build stronger reputations and trust among stakeholders. Environmental stewardship, social responsibility, and strong governance practices signal to investors, customers, and employees that a company is committed to ethical and sustainable practices. This trust enhances brand loyalty and attracts long-term investment.

- Employee Engagement and Retention: ESG factors have become important criteria for people entering the workforce. Employees who feel their company is making a positive difference in the world are more engaged, innovative, and likely to not only stay with their current employer but also build a long-term career there.

- Long-Term Sustainability: Sustainability is not just about environmental impact; it’s also about social equity and ethical governance. Companies that integrate ESG criteria are better positioned for long-term success. Sustainable environmental practices, fair social policies, and robust governance structures contribute to the overall resilience and longevity of a business.

- Stakeholder Alignment: ESG criteria ensure that a company’s actions align with the interests of all stakeholders, including shareholders, employees, customers, and the community. This alignment promotes a balance between profitability and positive societal impact, leading to more inclusive and equitable growth.

- Regulatory Compliance and Innovation: Adhering to ESG standards helps companies stay ahead of regulatory requirements and industry trends. This proactive approach fosters innovation, as companies develop new technologies and practices that meet environmental standards, address social issues, and enhance governance frameworks.

- Investor Appeal: Investors are increasingly integrating ESG criteria into their decision-making processes. Companies with strong ESG performance are seen as lower-risk and more sustainable investments. This investor confidence leads to better access to capital and more stable financial performance.

Conclusion

The integration of Environmental, Social, and Governance criteria creates a comprehensive framework for evaluating a company’s ethical and sustainable impact. Each component is essential, but their collective power drives transformative change. By prioritizing ESG criteria, companies can manage risks more effectively, build trust, ensure long-term sustainability, align stakeholder interests, foster innovation, and attract investment.

ESG is more than just a set of guidelines; it’s a holistic approach to responsible business that addresses the complex interconnections between environmental, social, and governance factors. Embracing ESG criteria is crucial for creating a better, more sustainable future for businesses and society alike.

Visit our website at https://envisionrise.com.

Why the UAE is Investing in Sustainability

Why the UAE is Investing in Sustainability

By Michael Benning, Executive Director True North Calibration at IpX

The United Arab Emirates (UAE) is investing heavily in sustainability for several strategic, economic, and environmental reasons. The Emirates’ oil and natural gas reserves are the world’s sixth and seventh largest, respectively, and for more than three decades, oil and global finance drove the UAE’s economy. In 2008-09, the confluence of falling oil prices, collapsing real estate prices, and the international banking crisis hit the UAE especially hard. The country is becoming less reliant on oil and gas and is economically focusing investment into healthcare, education, and infrastructure.

Here are five reasons the UAE is prioritizing sustainability and the potential return on investment (ROI) for these efforts:

Reasons for Investing in Sustainability

- Perhaps most significantly and immediately pressing is economic diversification:

-

- Investing in sustainable industries helps diversify the economy and reduce vulnerability to oil price fluctuations.

- New economic sectors: Sustainability initiatives are opening up new sectors such as renewable energy, green technologies, and sustainable tourism, creating job opportunities and stimulating economic growth. Many of these sectors require highly skilled professionals.

- Environmental Concerns:

-

- Climate change mitigation: Like many coastal areas, the UAE is vulnerable to the impacts of climate change, including sea-level rise, but also extreme heat. Over the longer term, investing in sustainability is expected to mitigate these risks.

- Resource management: Sustainable practices improve water and energy management, obviously crucial in a region with limited natural freshwater resources.

Global Image and Leadership:

Global Image and Leadership:

-

- International standing: By leading in sustainability, the UAE can enhance its global reputation and influence. Hosting events like the World Expo 2020 with a strong sustainability theme helps project this image.

- Compliance with Global Agreements: The UAE is committed to international agreements like the Paris Agreement, which requires significant investments in reducing carbon emissions.

- Innovation and Technology:

-

- Research and Development: Investing in sustainability fosters innovation and technological advancements. Initiatives such as Masdar City are positioned as hubs for clean technology and innovation.

- Attracting Investment: Sustainable projects attract foreign investment and partnerships, further boosting the economy.

- Social Development:

-

- Improving Quality of Life: Sustainable urban planning, renewable energy projects, and environmental conservation contribute to a higher quality of life for residents.

- Health Benefits: Reducing pollution and improving environmental conditions have direct positive effects on public health.

Return on Investment (ROI)

Economic Returns:

- Increased Foreign Investment: A strong commitment to sustainability is expected to attract global investors prioritizing green projects.

- Job Creation: The development of sustainable industries creates new jobs – many of which require highly skilled professionals – and stimulates economic growth.

- Energy Savings: Investments in renewable energy sources including wind and solar reduce dependence on fossil fuels, translating to long-term cost savings.

Environmental Benefits:

Environmental Benefits:

- Reduced Emissions: Investments in clean energy and sustainable practices significantly reduce greenhouse gas emissions, helping to combat climate change.

- Resource Efficiency: Improved water and energy efficiency leads to cost savings and more sustainable resource management.

Social Returns:

- Improved Public Health: Cleaner air and water, along with green spaces, lead to better health outcomes and reduced healthcare costs.

- Enhanced Living Standards: Sustainable urban developments improve living conditions, making cities more livable and attractive.

Long-Term Stability:

- Resilience to Oil Price Volatility: By diversifying the economy, the UAE becomes less vulnerable to fluctuations in global oil prices.

- Future-Proofing: Investing in sustainability ensures the UAE is better prepared for future environmental and economic challenges.

Examples of UAE’s Sustainability Initiatives

- Sharjah Research, Technology and Innovation Park Free Zone (SRTI Park) was established in 2016 by royal decree and was mandated to develop and manage an innovation ecosystem that promotes Research and Development (R&D) and supports enterprise activities, utilizing the triple helix collaboration of industry, government, and academia.

- Masdar City: An ambitious project aiming to be one of the most sustainable cities in the world, focusing on renewable energy and sustainable urban planning.

- Noor Abu Dhabi: One of the world’s largest single-site solar projects, contributing significantly to the UAE’s renewable energy capacity.

- Dubai Clean Energy Strategy 2050: Aims to provide 75% of Dubai’s energy from clean sources by 2050.

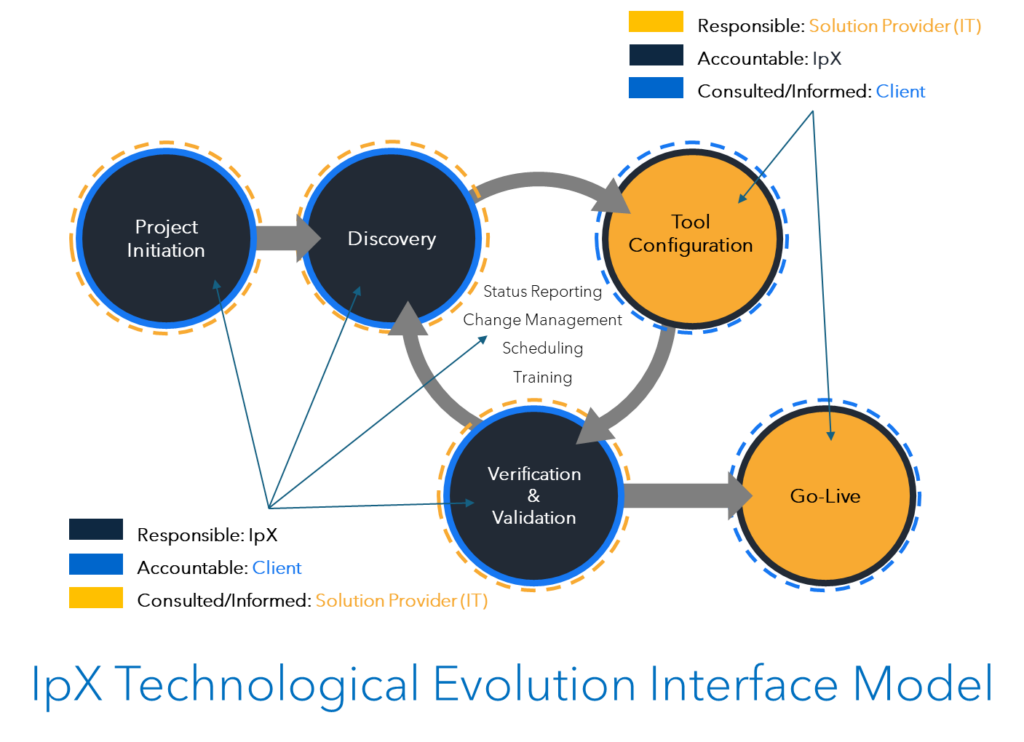

IpX

- To learn more about IpX, the “V-model”, or the Technological Evolution model, please visit ipxhq.com.

Who We Are…

The Envision RISE Human Strategy platform fulfills the needs of both the organization and the individual, going beyond traditional HR-centered initiatives. We build organizations that engage with the employee, the environment, and the community to encourage innovation and agility, with an eye toward greater engagement, ethical leadership, and sustainability.

Our Approach…

The RISE platform instills a novel way of thinking that focuses on fulfilling the needs of the individual and not simply an HR-centered initiative. This is an evolution from legacy Organizational Change Management (OCM) methods to a modern fit-for-purpose Organizational Evolution & Sustainability (OE&S) platform.

Services…

The RISE platform provides a voice to the individual and a framework critical to cultural sustainability, innovation and bottom-line enterprise efficiency. Through an ecosystem health survey & assessment, the RISE service model establishes clear objectives, concise indicators, and valid transformation plans that allow the enterprise to measure progress, ensure success, and continually improve.

Conclusion

The UAE’s investment in sustainability is driven by a strategic vision to diversify its economy, address environmental challenges, enhance its global standing, and improve the quality of life for its residents. The ROI on these investments is multifaceted, encompassing economic growth, environmental preservation, social benefits, and long-term stability. As these initiatives mature, they are expected to yield significant returns, both in financial terms and in the overall well-being of the nation.

Links:

UAE Sustainability Initiatives | EmiratesGBC

Masood M. Sharif Mahmood, CEO e&UAE

Bodour Al Qasimi, President of the American University of Sharjah

AGSIW | UAE: Norway’s Lessons for Economic Development and Sustainability

Visit our website at https://envisionrise.com.

Why ESG-Focused Companies are Viewed as Having Long-Term Value

Why ESG-Focused Companies are Viewed as Having Long-Term Value

By Staci Hegarty, M.Ed.

The integration of ESG principles helps companies create sustainable value, ensuring they are well-positioned for long-term success and resilience in a rapidly changing world.

But Why?

ESG stands for Environment, Social, and Governance. More specifically, how does your organization address environmental sustainability, take care of the humans who interact with the company, and ethically lead through the board, executives and directors?

Investors are increasingly favoring companies that demonstrate strong ESG practices. In a survey of 50 Fortune 100 companies, ESG-related disclosure in 10-K and meeting proxy statements has increased significantly since 2021. A robust ESG strategy signals to investors that a company is forward-thinking, resilient, and committed to long-term value creation. This can lead to greater access to capital, more favorable financing terms, and enhanced shareholder value.

ESG is Complex

The term ESG is most often used in relation to the interests of investors but applies to the overall strategy of every organization. ESG integration, cited by almost six in 10 (59%) global investors, remains the most used implementation strategy. Depending on the industry, one of the three categories may be more important than the others. A mining company is going to focus more on the environmental impact of their work than an accounting firm. A company with vendors in developing nations will have greater concerns about child labor than an insurance company. A large publicly traded organization will prioritize corporate governance differently than a small construction company. The priorities may be different, but the importance of each of these three factors cannot be overstated. ESG-focused institutional investments are projected to reach $33.9 trillion by 2026.

ESG factors are crucial in identifying and mitigating risks that can significantly impact a company’s long-term viability. Environmental concerns like climate change can lead to regulatory changes, operational disruptions, and increased costs. Social factors, such as labor practices and community relations, can affect brand reputation and customer loyalty. Strong governance ensures transparency and accountability, reducing the likelihood of scandals and financial mismanagement.

Long-Term Value Creation

ESG is not just about doing good—it’s about creating long-term value. Companies that prioritize ESG factors are better equipped to innovate, adapt to changing market conditions, and build sustainable business models. This, in turn, leads to enhanced financial performance, competitive advantage, and long-term success.

In addition, consumers today are more socially and environmentally conscious than ever before. A significant 76% of consumers would stop buying from companies that neglect environmental, employee, or community well-being. Consumers are increasingly demanding that companies align their operations with ethical and sustainable practices. Companies that integrate ESG into their business models can attract and retain customers who prioritize sustainability, ultimately driving sales and brand loyalty.

Integrating ESG into your strategies is not just a matter of corporate responsibility—it’s a business imperative. By focusing on ESG, leaders can protect their organizations from risks, attract investors, meet regulatory requirements, satisfy consumer demands, and build a motivated workforce, all while ensuring long-term value creation. In an increasingly complex world, ESG is the roadmap to sustainable success.

5 main reasons why ESG-focused companies are viewed as having long-term value:

- Employee Safety and Retention: By investing in their employees’ safety and well-being, companies can reduce turnover rates and maintain a skilled, motivated workforce. This stability contributes to maintaining best practices and operational efficiency over the long term in addition to increasing morale. By embracing ESG, companies can attract top talent, foster a positive workplace culture, and reduce turnover rates.

- Waste Reduction and Efficiency: Investing in sustainable practices, such as reducing waste, becomes ingrained in the company culture. This leads to operational efficiencies, cost savings, and a stronger bottom line.

- Regulatory Compliance: Staying ahead of regulatory changes means these companies are better equipped to manage and respond to new requirements. This proactive approach ensures compliance not only with regulations but also with evolving market and customer expectations. In addition, governments and regulatory bodies around the world are implementing stricter ESG-related regulations. Companies that proactively address ESG issues are better positioned to comply with these regulations, avoiding penalties and maintaining their license to operate.

- Innovation and Problem-Solving: ESG-focused companies often excel in innovative problem-solving. Their commitment to addressing environmental and social challenges fosters a culture of creativity and adaptability. This agility allows them to quickly respond to changes in the market, supply chain disruptions, and other business factors.

- Reputation and Trust: Companies that prioritize ESG build stronger relationships with stakeholders, including customers, employees, and investors. This trust and positive reputation can lead to increased customer loyalty, better employee engagement, and more attractive investment opportunities.

The Time is Now

By embedding ESG principles into your core operations, you not only enhance your company’s resilience and long-term value but also build trust with stakeholders. Ensure your current ESG initiatives are effective, well-documented, and visible both internally and externally. This transparency strengthens your reputation and demonstrates your commitment to sustainable and ethical practices, positioning your company as a leader in today’s rapidly evolving market.

An integrated approach is essential to ensure the right information is available and targeted to all stakeholders. This approach helps align your ESG goals with your overall business strategy, ensuring that everyone from employees to investors understands and supports your initiatives. By doing so, you create a cohesive and informed environment that drives sustainable success.

How We Engage 1, 2, 3

ESG factors are crucial in identifying and mitigating risks that can significantly impact a company’s long-term viability. Envision RISE has the expertise to lead your organization’s development and execution of ESG goals and initiatives.

- Step 1: Collaboratively, we assess and understand your current state.

- Step 2: Together, we conduct a gap analysis aligned with your goals and objectives.

- Step 3: We define both near-term and long-term action plans, focusing on quick wins.

- Step 4: We outline an internal and external socialization and visibility plan.

Schedule your free 30-minute consultation here:

https://calendly.com/staci-h/30-minute-consultation

If we find that we’re a good fit, we’d like to offer you 5 hours of free services. Should you wish to continue, you’ll receive 25 complimentary hours of support with every purchase of 100 bulk hours . Offer is valid through November 31st, 2024.

Visit our website at https://envisionrise.com.

The Little Things Matter in Employee Retention

The Little Things Matter in Employee Retention

By Staci Hegarty, M.Ed.

The statistics are well known. It takes 50% (or more) of an employee’s annual salary to replace them if they leave. Unemployment is at a 50-year low. Competition for talented employees is fierce. Baby Boomers will all be at

traditional retirement in 2030, contributing millions of roles to the labor shortage. Companies are struggling with work-from-home policies, the introduction of AI into our daily lives, skyrocketing health insurance costs, and the need for a global workforce.

On average, workers leave companies after only four years. The days of decades of loyalty to an employer are gone. This is not because employees are fickler, but because the grass may truly be greener somewhere else. Few jobs reward that kind of loyalty anymore. Pensions only exist in a handful of industries. 401k matching is becoming rare. Employees have been prioritizing work-life balance more than ever. Few families can afford to have a stay-at-home parent, which means working parents must walk a tightrope between their professional goals and their personal obligations. An annual cost of living raise will not be enough to retain high-potential or high-contributing employee.

Rather than compete for new employees, it is more cost-effective and productive to invest in your existing employees. Our jobs are more than a paycheck. They are where we spend about a quarter of our lives. Studies show that our boss has a greater impact on our mental health than a doctor or therapist, with influence that is comparable to that of our life partners. Leaders who are connected to their employees on a personal level create one of the most important aspects of a healthy workplace, a sense of belonging for their employees. When employees feel cared for, they are less inclined to leave.

Opportunities for growth and promotion are another significant factor in employee retention. Not every employee will be promoted to a leadership role, and not every employee wants that. Professional development, formal mentorship programs, and upskilling is a benefit to both the employee and the organization and have been proven to increase employee engagement and retention. An employee who is underperforming in their current role may benefit from a lateral move to another department. An entry level employee may become more invested in their work if they are part of a leadership succession program. Most people don’t need to have an immediate promotion or change but will be more engaged when they are actively participating in something that helps them develop their skills for the future.

Recognition is another known factor in employee retention. Annual recognition awards are common. While important, these awards are not as impactful as frequent, informal recognition. A simple moment of praise during the weekly department meeting, done sincerely and regularly, can improve an employee’s mindset and connection with work. Recognition does not have to be for extremely high performance, it can and should include praise for the little things that help make the big things happen. Leaders should always be on the lookout for the actions and behaviors that may otherwise go unnoticed, especially from people who have jobs that are not high-profile or consistently celebrated. Praise for the salesperson who lands a big account is obvious and expected, praise for the marketing specialist who caught a typo in a mass email before it went out may not be as obvious or expected. When we feel like our contribution matters, we feel more

connected to the organization.

Leaders do not have control over everything in their market or industry. They do not have control over the economic climate of the country. What they DO have control over is what they do to let their employees know that their role is important, and their work is not invisible. Recognize, reward, and promote your existing employees and they will return that energy with greater engagement, innovation, and loyalty. If you aren’t sure what your employee engagement plan is missing, connect with our experts at Envision RISE to transform your organization’s employee retention efforts at info@envisionrise.com.